Tailored for Nomads: The New SafetyWing Nomad Insurance Plans

I’ve been working remotely since 2017, and before then I would already leave my home country for several months or years for study and work. As a long-term traveler, I’ve learned a lot about the highs and lows of nomadic life. While there are countless breathtaking moments, there are also unexpected challenges, especially when it comes to staying healthy on the road.

Over the years, I’ve faced my share of health issues while traveling and discovered just how important good travel insurance is. Inadvertently, I became sort of an ambassador for this type of product through my own experiences, haha. Luckily it was never too serious, otherwise it wouldn’t just have been important, but a literal lifesaver.

On this article, I’ll talk about the travel insurance solution I currently find most cost-effective and practical for nomads and remote workers from all over the world. But before that, I’ll share some of my mishaps, in the hope to convince you to never travel unprotected.

4 times I was truly glad I had travel insurance

- Urinary Infection in Budapest

Budapest is one of my favorite cities in the world, and I lived there in three different periods. The second and longest one, where I did an internship at an NGO while also working remotely, was a real dream—until it wasn’t. A painful urinary infection hit me out of nowhere.

As someone far from home, in a country where I didn’t speak the language, I was grateful my travel insurance covered the doctor’s visit and medication, saving me from unnecessary stress and allowing me to focus on my recovery.

- Food Poisoning in Mexico City

I thought I was prepared for Mexico’s incredible street food scene, but my stomach had other plans. After spending a whole month traveling around the country and eating countless tacos and other delicacies, I was hit with the worst food poisoning of my life. I had a fever, got dehydrated and couldn’t keep anything down.

To make things worse, this happened the day before I was flying out of the country towards my next destination. Thanks to my travel insurance, I got medical help without worrying about the cost, and within 24 hours I was already feeling well enough to board the plane.

- Throat Infection in London

I also love London, but the city’s unpredictable weather did me no favors the last time I was there. When I came down with a nasty throat infection, I waited for a few days, but it wasn’t getting any better. I finally went to a really good clinic, which was easily accessible by subway, and got proper treatment with antibiotics. The fact that I had travel insurance allowed me to stay inside my travel budget, and I felt a lot better in a few days.

- A Strained Ankle in Lyon

While wandering the cobblestone streets of Vieux Lyon (the Old Town of this beautiful French city where I spent some time studying French), I awkwardly twisted my ankle. I still had almost two months left there, so waiting to come back home to get medical care was obviously out of the question. With my insurance covering the cost of consultations, I got the help I needed without breaking the bank. I followed the doctor’s instructions carefully and recovered quick enough to be able to enjoy the rest of my time there walking with both feet.

The hassle of juggling health insurance as a nomad

While travel insurance saved me in those situations, one of the biggest headaches for me as a Brazilian traveler who alternates periods traveling abroad and in Brazil has always been managing health insurance at home.

Whenever I’d leave the country for an extended trip, I would either cancel my local health insurance and reapply upon my return (which is very bureaucratic) or pay for it while I wasn’t even using it—on top of paying for travel insurance. Neither option felt great.

Luckily, these days there’s a solution to this. I’ve already spoken about SafetyWing’s Nomad Insurance on the blog a few times, because I’m quite happy to see that there’s finally a good product made by nomads, for nomads.

Founded in 2018, SafetyWing is already a trusted name in nomadic travel insurance, and they’re always improving their products and services. With their updated Nomad Insurance it got even better. Luckily, nowadays there’s no longer the need to juggle two insurances or waste money on unused coverage.

How SafetyWing’s plans make life easier

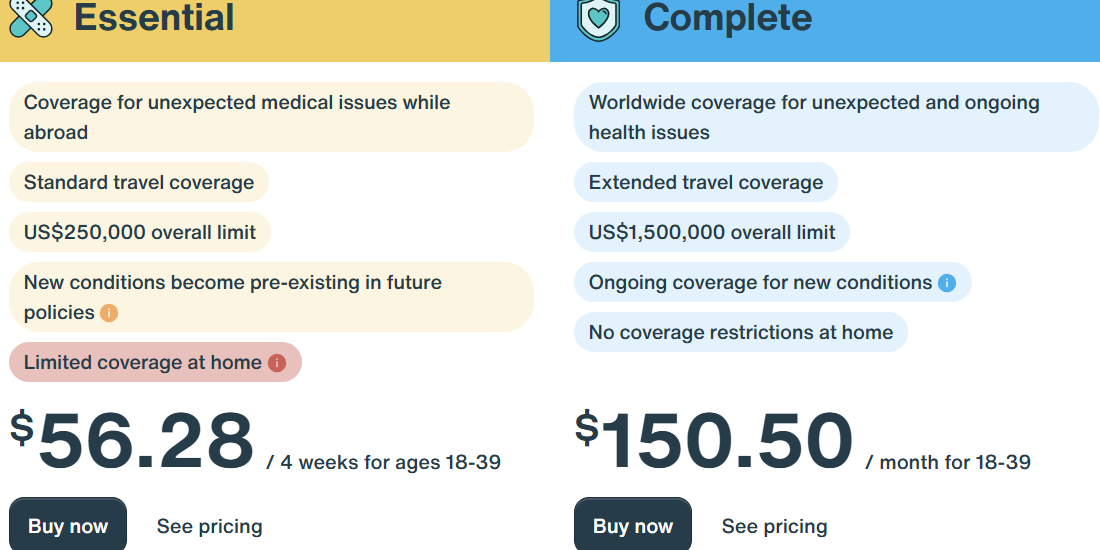

So, the news is that SafetyWing’s Nomad Insurance recently got split into two options. The Complete plan offers full coverage even in your home country, and the flexibility to use it wherever you go – which is everything my past self would dream of. And if you’re simply looking for regular travel insurance to give you peace of mind for emergencies, their Essential plan is a great choice.

With features like trip protection, medical evacuation, and optional add-ons, both plans are designed with flexibility in mind. Here are some highlights:

- The Essential Plan: Starting at just $56 for 4 weeks, the Essential Plan (previously just Nomad Insurance) is perfect for short-term adventurers or remote workers who want emergency medical coverage while traveling. It covers emergency medical issues, trip delays, and other issues, and there’s the option to get add-ons for adventure sports and electronics theft. You can choose fixed dates for short trips or subscribe to it with automatic renewal on a 28-day cycle, but it only works while you’re outside your home country. It’s affordable and ideal for anyone hitting the road temporarily, while also particularly convenient for nomads, since you can hire it while you’re already on the road and set up automatic renewal.

- The Complete Plan: Starting at $150.50 per month, this plan caters to long-term nomads, providing comprehensive health and travel coverage that also works in your home country. It includes all the benefits of the Essential plan but adds health coverage for routine check-ups, mental health support, and maternity care. Plus, it provides full coverage in your home country, making it a great choice for those who need flexibility between extended trips. There’s a minimum contract of 12 months, paid monthly or yearly. This was previously known as the Nomad Health plan.

How to choose the right plan

With the recent changes made by SafetyWing it became much easier to choose the level of coverage that suits your needs. If you’re debating which plan is best for you, consider your priorities:

- Are you taking shorter trips or working remotely for a few months at a time? You might be good with the Essential Plan.

- Do you plan to travel long-term, live abroad, or require coverage at home? The Complete Plan is worth the investment.

My favorite things about this Nomad Insurance

Many of my nomad friends say that SafetyWing’s new Nomad Insurance is more than just insurance—it’s a lifestyle enabler. I was already a fan of many of their features, such as the optional add-ons for adventure sports or electronics theft and the automatically renewable subscription, which are present in the Essential Plan. Being able to top that with comprehensive coverage in our home country just makes it even better.

Another feature that I really like about SafetyWing is their easy claims process, which I’ve talked about in this article. Although I do prefer insurance products that allow me to get treated for free, instead of paying for consultations and getting reimbursed later, the flexibility of their products compensates for this.

When you need to claim a reimbursement, you simply log into your SafetyWing dashboard and click “Make a claim.” Then you fill out a short form and upload your documents, receipts, and medical notes stating the treatment you had and why. Claims are usually reimbursed in up to 21 days. They also launched an app, which makes the process even easier.

FAQs about SafetyWing’s Nomad Insurance

Is Nomad Insurance a type of health insurance?

Yes, as long as you select the right plan. The Nomad Insurance Essential plan is a travel medical insurance, designed specifically to handle emergency accidents and illnesses that may arise during your trips. It doesn’t serve as a substitute for full health insurance. On the other hand, the Complete plan expands on the Essential’s coverage, providing a fully comprehensive health insurance solution. It combines travel and health benefits, so you’re protected beyond emergencies.

How much does the Nomad Insurance cost?

The Essential plan currently costs US$56.28 every 4 weeks for travelers aged 10-39 years, while the Complete plan starts at US$150.50 every month for ages 18-39. All prices increase with age, and they can be updated after I’ve published this. You can quickly generate an updated quote according to your needs by using the price calculator on their website.

What coverage add-ons are available?

Nomad Insurance offers three optional add-ons for extra coverage: adventure sports for high-risk activities, electronics theft, and travel to the US. The adventure sports and electronics theft add-ons cost $10 per 4 weeks and are only available with subscription policies that are automatically renewed every 4 weeks. For travel to the US, you can purchase the US coverage add-on, which is available for both subscription and fixed-date policies. The cost for US coverage depends on your age.

What is not covered by Nomad Insurance?

The Essential plan doesn’t cover pre-existing conditions, high-risk or professional sport activity, cancer, or maternity, in addition to flights, accommodations or excursions that were canceled before you left and certain lost/stolen belongings.

The Complete plan also does not cover pre-existing conditions, as well as aesthetic or cosmetic treatments, orthodontic treatment, obesity or weight control treatments, over-the-counter medications, birth control, professional sports or gym or fitness memberships.

To see the full list of exclusions, carefully read each policy on SafetyWing’s website.

Ready to travel worry-free?

If you’ve ever dealt with the stress of managing multiple health insurances or faced unexpected health issues abroad, SafetyWing’s plans might be the solution you’ve been looking for. With options for all kinds of travelers, they make it easier for us to focus on enjoying our trips, without worrying about the “what ifs”.

Disclaimer: This isn’t a sponsored article, but I”m a SafetyWing Ambassador because I truly believe in their product. When you purchase your travel insurance using the links on the blog, I earn a small commission that allows me to continue producing useful content for travelers, and you don’t pay anything extra for it. This blog values transparency with its readers and always makes it clear when there is financial compensation involved in mentioning a service or product.

0 Comentários